7 Things To Know Before Buying A House

Buying your first home is one of the most exciting times in any person’s life. There is so much to do and so many new and exciting things that you can look forward to when you buy your first home.

However, there are a lot of things that you should know before buying a home. While some people can get advice from their parents and friends, others prefer doing everything alone to be independent.

If you’re the second type of person, here’s a list of all the things you should know before buying your first house so that you don’t have to ask anyone.

The Right Realtor

Unsplash

Buying a house for the first time can be a daunting process. There is a lot of real estate and legal jargon that you probably won’t be familiar with, there is a lot of work to be done, and it can all be quite overwhelming.

For this reason, you need to find a realtor who you know has your best interests at heart and that will assist you throughout the process. Having the right realtor will make a world of difference to the ease and comfort with which this process moves.

Do Your Research

Unsplash

You know already what sort of house you’d ideally like to move into. You might already have been to view a couple of places on a Sunday afternoon, but that is not enough research to know exactly what you want.

You should compare property prices in different areas, find out which sites are set to become more expensive, which areas’ property values are set to drop, etc. Doing this will help you to make an informed decision about where you would like to live.

Save For More Than A Downpayment

Unsplash

It is important to have saved enough money for a downpayment, but you should also save just a little extra than the downpayment. This might seem a little odd, but it makes perfect sense when you think about it.

Moving into a new place might mean that you have to fix or change some of the things that the previous owners left there, so you will need to have extra money saved up for these kinds of occasions.

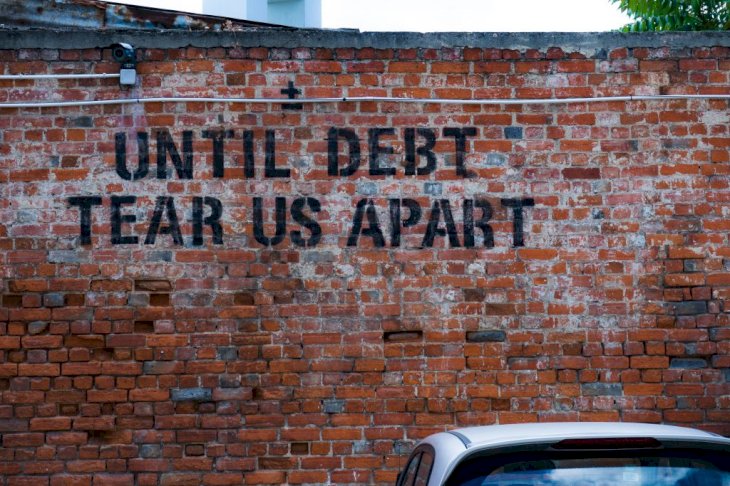

Consider Your Debt

Unsplash

If you have any debts, you should aim to have them paid before applying for a home loan. When you have debt (even student debt), you are less likely to be given a loan because you will not be seen as being capable of paying it.

You should make sure that your debt has been paid off far in advance to you applying for a home loan so that you can be approved and the home buying process can move a little faster.

Speak To Pros

Unsplash

If you have the budget for it, speaking to professionals is an excellent way to ensure that your best interests are taken care of. These professionals can be anybody from experienced realtors to property lawyers.

Getting other people involved who know what they are doing can only help you set up contracts etc., a little bit better and ensure that you are covered in any situation.

Location, Location, Location

Unsplash

This is an age-old real estate quote, and it has been around for so long simply because it holds so much truth. The location in which your purchase your first home is far more important than the home itself.

You must consider schools, hospitals, shopping centers, and other amenities while still ensuring that it is in reasonable proximity to your workplace and you will be able to sell your house for an affordable price if you ever want to.

Look In The Garden

Unsplash

For many people, their search stops at the back door of a house. If everything up until there looks okay, they’re ready to commit. However, there’s much more to look for than the inside of the house.

You should also consider how much the garden will cost to maintain and if there are any big trees, how much it would cost to remove them if you ever needed to. Doing this will help you avoid surprise costs.